By Cindy Cummings

On average, homeowners in California will pay $1,925 in property tax annually. The deadline for the most recent payment was April 10, 2020, but Los Angeles County gave locals the opportunity to delay their tax payments due to so many people having financial issues as a result of the COVID-19 outbreak. But if you have deferred your property tax payment, the benefits of paying up as soon as possible outweigh the cons.

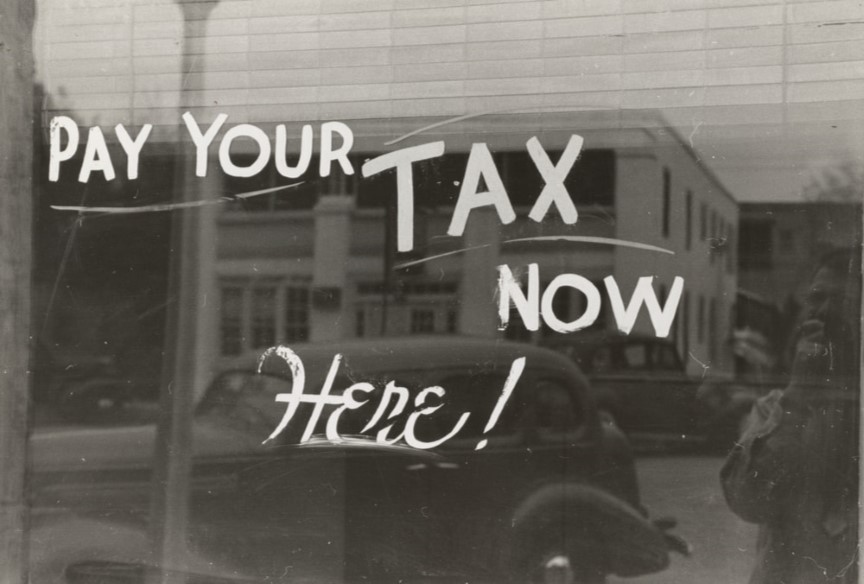

Urging taxpayers to pay

In normal circumstances, residents in Los Angeles County face a 10% penalty plus a $10.00 cost when they fail to pay their property tax by April 10. However, this year, many locals have been able to apply to the County Treasurer and Tax Collector’s office for an exemption. With the county enforcing a stay at home order until at least May 15, many natives are unable to go to work or pay their bills. But Los Angeles County Assessor Jeffrey Prang has pleaded with locals, saying “if you can pay, we urge you to pay.” This is because these taxes help to cover the cost of crucial equipment for public health professionals and emergency medical help, both of which so many people in the county are relying on right now.

Finding the cash

Finding ways to pay your property tax bill is therefore crucial. One option is to delve into your savings pot. 63% of households in California have some form of savings, according to The Mercury News so it’s worth utilizing the cash you’ve already got stashed away. Alternatively, you may be eligible for quick loans for bad credit if you’re one of the many Californians with a poor credit rating. Typically, you’ll be able to borrow up to $2,500 and it’s possible to be approved for this type of financial help in a matter of minutes, meaning you’ll be able to swiftly pay what you owe to the county.

The importance of paying now

The LA Times predicts that by the end of the second quarter, 16.4% of Californians will be unemployed. At this point, many locals will find it even more difficult to pay their overdue property taxes than they would now. It’s also important to remember that payment delay requests are reviewed on a case by case basis so there’s no guarantee yours will be accepted. Plus, the next property tax payments will be collected in November so it won’t be long before there are even more fees to pay.

The property tax deadline for LA County has come and gone. While many will have been delighted by the reprieve the county has offered up, it makes financial sense to pay this tax bill as soon as possible.

–